Walgreen's Reboot

Walgreens Boots Alliance, Inc. (WBA) operates Walgreens pharmacies. Walgreens business includes the operation of retail drugstores and convenient care clinics, in addition to specialty pharmacy services.

[PostStockWidget stock_valuation="" pricetype="live" manual_date="Dec. 21, 2012, 2:04pm GMT" symbolcodes="'WBA'" symbolprices="80" div_align="right"]

Walgreens is a household name that has distinguished itself as a high quality Purple Chip in a defensive sector.

In difficult economic periods, earnings have declined but only slightly followed by renewed periods of growth. The outlook for the earnings remains positive and should ultimately take the stock back to a higher valuation.

Purple Chips 12 -18 month target is: $USD 96.00

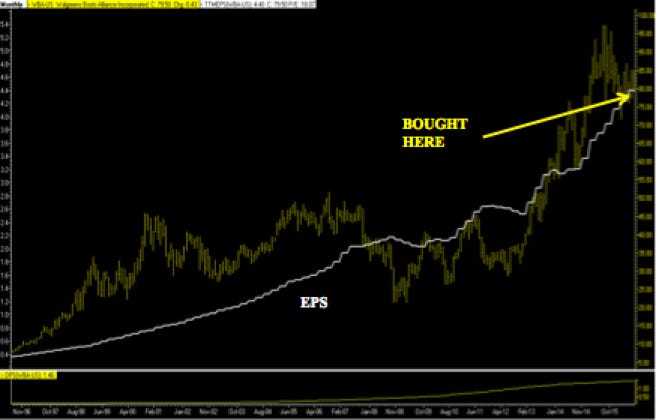

LOW VALUATION IN WALGREENS AT $79.15 (WBA-US) FULL POSITION

PURPLE CHIPS TARGET: $96.00 POSITION SIZE: FULL (5.0%) P/E: 18.0X DIV: $1.50 (1.9%) MKT CAP: $86B Debt: $10B NOPCF per share: 138% EARNINGS YIELD: 6.7% 5 YR EPS Growth rate*:12.5% P/E/G Ratio: 1.5X 2016 EPS: $4.40 2017 EST.: $4.99 2018 EST.: $5.58

*Blended growth rate= 2/3 historical (5yrs), 1/3 forward.