Snap, Crackle, Pop

Kellogg Company is a maker of cereal and convenience foods. As of February 2013, their products were marketed in more than 180 countries. Kellogg also markets cookies, crackers, crisps, and other convenience foods, under brands, such as Kellogg's, Keebler, Cheez-It, Murray, Austin and Famous Amos, to supermarkets in the United States.

[PostStockWidget stock_valuation="" pricetype="live" manual_date="Dec. 21, 2012, 2:04pm GMT" symbolcodes="'K'" symbolprices="60" div_align="right"]

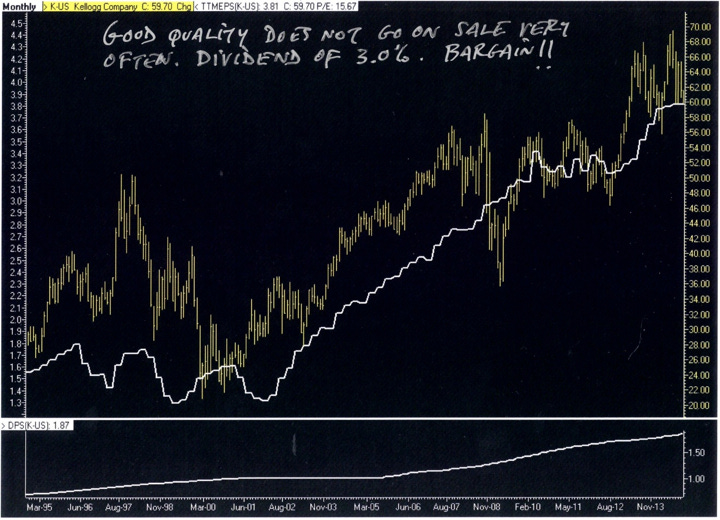

This food giant is a household name in a recession proof business. They have a healthy balance sheet and have not often been in bargain territory. If one excludes the credit crisis, the current valuation is among the lowest that has been seen in the last 20 years.

Purple Chips 12 -18 month target: $69.00

LOW VALUATION IN KELLOG AT $59.80 (K-US, $59.60) FULL POSITION

PURPLE CHIPS TARGET: $69.00 POSITION SIZE: FULL (5.0%) P/E: 15.7X DIV: $1.96 (3.2%) MKT CAP: $21B Debt: $7B RETURN ON CAPITAL: 35.8% EARNINGS YIELD: 11.4% 5 YR EPS Growth rate*:6.15% P/E/G Ratio: 2.55X 2014 EPS: $3.81 2015 EST.: $4.09 2016 EST.: $4.36

*Blended growth rate= 2/3 historical (5yrs), 1/3 forward.