Game. Stop.

GameStop Corp is a multichannel video game retailer. It sells new and used video game hardware, physical and digital video game software, accessories, as well as personal computer (PC) entertainment software and other merchandise. As of January 28, 2012, its retail network of brands includes 6,683 Company-operated stores in the United States, Australia, Canada and Europe, primarily under the names GameStop, EB Games and Micromania. It operates in four segments: United States, Canada, Australia and Europe.

[PostStockWidget stock_valuation="" pricetype="live" manual_date="Dec. 21, 2012, 2:04pm GMT" symbolcodes="'GME'" symbolprices="37" div_align="right"]

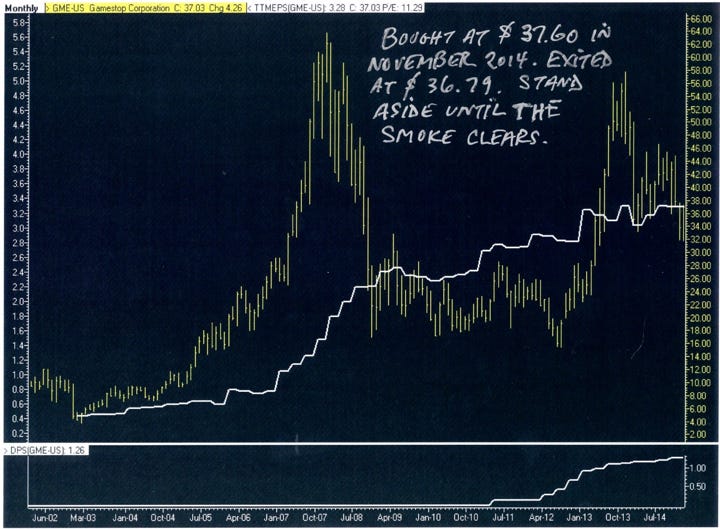

We bought Gamestop in November 2014 at $37.60. Gamestop has become a controversial stock with many polarized views and the chorus on both sides has been getting louder.

It has a strong balance sheet but it is clear that major changes are necessary to adapt to the reality of games on disk versus games on line.

At Purple Chips, we don’t like to lose money, but sometimes we will take a small loss if we can switch to better quality. We will stand aside until the smoke clears and look for lower risk opportunities.

EXIT GAMESTOP AT $36.79 (GME-US, $36.99) FULL POSITION

PURPLE CHIPS TARGET: $54.00 POSITION SIZE: FULL (5.0) P/E: 11.5X DIV: $1.32 (3.83%) MKT CAP: $4B DEBT: NIL RETURN ON CAPITAL: 83.6% EARNINGS YIELD: 16% 5 YR EPS Growth rate*:9.8% P/E/G Ratio: 1.2 EPS: $3.28 2015 EST.: $4.09 2016 EST.: $4.61

*Blended growth rate= 2/3 historical (5yrs), 1/3 forward.