Cashing In on Canadian Banks: An Opportunity Awaits?

21Aug23 Navigating the Current Banking Landscape

Update #511: John and Raymond discuss the current attractiveness of Canadian banks, highlighting their historical trends, and investment opportunities, while also addressing concerns related to market conditions and portfolio considerations.

Below you will find Audio + Transcript + Charts

Audio

Here’s a synthesized audio playback of the Purple Chips call between John and Raymond. You can adjust the playback speed.

Transcript

Please note that Bank of Montreal, also known as B-MO, and Royal Bank, trade on both the New York and Toronto exchanges under the symbols BMO and RY. The dollar figures in this BlogCast are in "Canadian" dollars.

Raymond: Raymond: Good morning, John. Canadian banks are always a hot topic. What's your current take on them?

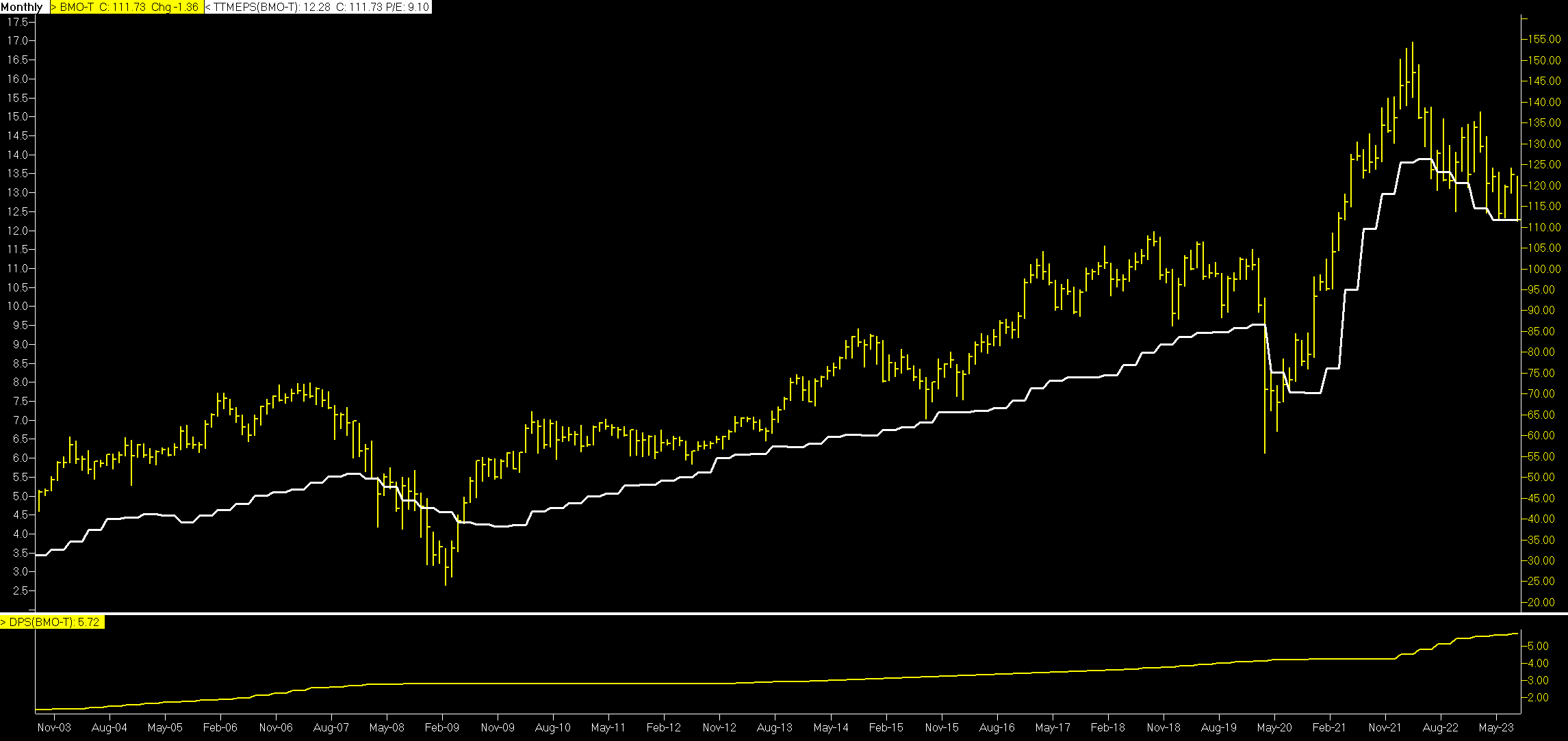

John: Good morning, Raymond. You're right, Canadian banks are essential, especially for Canadian investors. Right now, they're looking quite attractive. For example, Bank of Montreal is trading around $113, down from a high of $155 in the last two years. Royal Bank is around $121, down from $150. It's a pretty reasonable discount.

Raymond: So which Canadian bank is most appealing to you right now?

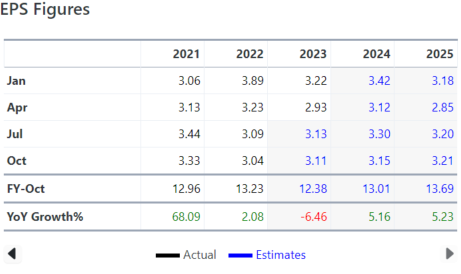

John: After analyzing the earnings forecasts and eliminating those with stagnant earnings, I'm leaning towards Bank of Montreal. It's more attractively valued and has a promising outlook. With a 5.2% dividend yield and trading at 9.2 times earnings, it's hard to ignore. Historically, it has traded between 9 and 11 times earnings and at 9.2X we're close to the lowest valuation I've seen in the last 20 years.

Raymond: Why do you think the prices are down in the big banks?

John: It's a mix of factors. There's been talk about higher provisions for loan losses, impacting earnings. But I think we'll see earnings starting to come back to their usual growing trend, but the market is overshooting on the downside. It's an extreme point, but it's an opportunity. The valuation is below the average right now, which makes it even more appealing.

Raymond: Could high interest rates slowing down the housing market also be a factor?

John: Absolutely, that's part of the concern. But historically, buying banks at these valuations has been a good move. The odds of making money are good, and the return possibilities look promising at this level.

Raymond: What about holders of other Canadian banks? Should they consider swapping for BMO?

John: It's not necessarily about swapping, but more about considering the weighting in your portfolio. If you have less than 15 or 20% in banks, adding Bank of Montreal could be wise. It's attractively valued, and the percentage return possibilities are good.

Raymond: And what about our American readers? These banks are traded in the US too, right?

John: Yes, they are, and the attractiveness holds true there as well. It's the same appealing picture. The valuation at 9.3X earnings, the dividend yield at 5.1%, and the historical trends all point to a great investment opportunity.

Raymond: Anything else to add, John?

John: Just that this is an opportunity that's showing up right now, and I think it's quite attractive. If anyone knows how to make money, it's the banks.

Raymond: Great, thanks again, John. Always a pleasure to hear your insights.

Charts

for BMO

for RY